USA ヘンプ・ミュージアム

館長から皆さまへ

館長から皆さまへ ヘンプの歴史

ヘンプの歴史 ヘンプと農業

ヘンプと農業 ヘンプの医療と健康

ヘンプの医療と健康 ヘンプ食品

ヘンプ食品 ヘンプ織物

ヘンプ織物 ヘンプ縄と糸

ヘンプ縄と糸 ヘンプパルプ紙

ヘンプパルプ紙 ヘンプ建材

ヘンプ建材 ヘンプ燃料

ヘンプ燃料 ヘンプ原料

ヘンプ原料 ヘンプ溶剤

ヘンプ溶剤 ヘンプ・プラスチック

ヘンプ・プラスチック ヘンプと環境

ヘンプと環境 ヘンプと娯楽と精神世界

ヘンプと娯楽と精神世界  ヘンプと法律

ヘンプと法律 ヘンプと法律

ヘンプと法律 ヘンプとアメリカ憲法

ヘンプとアメリカ憲法 医療ヘンプの法律

医療ヘンプの法律 産業用ヘンプの法律

産業用ヘンプの法律 マリファナ税法 1937

マリファナ税法 1937 解決策 禁止法廃止

解決策 禁止法廃止 政府とバトラーの論争

政府とバトラーの論争 アラスカ合法化へ

アラスカ合法化へ 書簡

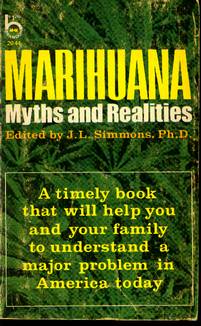

書簡 マリファナ雑誌

マリファナ雑誌 館長の裁判闘争

館長の裁判闘争 法律関連図書

法律関連図書  ヘンプと政治

ヘンプと政治 ヘンプ貢献者

ヘンプ貢献者 ミュージアム図書館

ミュージアム図書館 Topに戻る

Topに戻る |

|

The hearings on the Marijuana Tax Act of 1937, before the House Committee on Ways and Means, is 125 pages. Following is a greatly condensed version of maybe 4 or 5 pages. Thanks to James Dawson for this version from the original hemp museum. How the congress was duped to pass a measure that eradicated an industry, and started the MYTH OF MARIJUANA. HEARINGS BEFORE THE COMMITTEE ON WAYS AND MEANS HOUSE OF REPRESENTATIVES SEVENTY-FIFTH CONGRESS FIRST SESSION ON H.R. 6385 APRIL 27,28,29,30, AND MAY 4, 1937 TAXATION OF MARIHUANA WEDNESDAY, TUESDAY, APRIL 27, 1937 The term "marihuana: includes all parts of the plant Cannabis sativa L., whether growing or not; the seeds thereof; the resin extracted from any part of such plant; and every compound, manufacture, salt, derivative, mixture, or preparation of such plant, its seeds, or resin; but shall not include the mature stalks of such plant, or any product or manufacture of such stalks, except the resin extracted there from and any compound, manufacture, salt, derivative, mixture, or preparation of such resin.(p.1) THE PURPOSE OF H.R. 6385 IS TO EMPLOY THE FEDERAL TAXING POWER NOT ONLY TO RAISE REVENUE FROM THE MARIHUANA TRAFFIC, BUT ALSO TO DISCOURAGE THE CURRENT AND WIDESPREAD UNDESIRABLE USE OF MARIHUANA BY SMOKERS AND DRUG ADDICTS AND THUS DRIVE THE TRAFFIC INTO CHANNELS WHERE THE PLANT WILL BE PUT TO VALUABLE INDUSTRIAL, MEDICAL, AND SCIENTIFIC USES. IN ACCOMPLISHING THIS GENERAL PURPOSE TWO OBJECTIVES SHOULD DICTATE THE FORM OF THE PROPOSED LEGISLATION: FIRST, THE DEVELOPMENT OF A SCHEME OF TAXATION WHICH WOULD RAISE REVENUE AND WHICH WOULD ALSO RENDER VIRTUALLY IMPOSSIBLE THE ACQUISITION OF MARIHUANA BY PERSONS WHO WOULD PUT IT TO ILLICIT USES WITHOUT UNDULY INTERFERING WITH THE USE OF THE PLANT FOR INDUSTRIAL, MEDICAL, AND SCIENTIFIC PURPOSES; AND SECOND, THE DEVELOPMENT OF AN ADEQUATE MEANS OF PUBLICIZING DEALINGS IN MARIHUANA IN ORDER THAT THE TRAFFIC MAY BE EFFECTIVELY TAXED AND CONTROLLED.(P.7) Since hemp fiber and articles manufactured there from are obtained from the harmless mature stalk of the plant, all such products have been completely eliminated from the purview of the bill by defining the term "marihuana" in the bill, so as to exclude from its provisions the mature stalk and its compounds or manufacturers. There are also some dealings in marihuana seeds for planting purposes and for use in the manufacture of oil which is ultimately employed by the paint and varnish industry. As the seeds, unlike the mature stalk, contain the drug, the same complete exemption could not be applied in this instance. but this type of transaction, as well as any transfer of completed paint or varnish products, has been exempted from transfer tax. Any negligible medical use which marihuana may have will also be left largely unrestricted by this bill.(p.8) This order form (for transfer) does not apply however to a transfer of marihuana by a practitioner to his patient, or by a druggist to a consumer who presents to the druggist a prescription issued by a practitioner registered under the act. Nor does it apply to exportations of marihuana, transfers of marihuana to Government officials, transfers to paint or varnish of which marihuana is an ingredient, transfers of marihuana to registered persons for use in the manufacture of paint or varnish and transfers of seeds of the marihuana plant.(p.9) In order to obviate the possibility of a similar attack upon the CONSTITUTIONALITY of this bill, it like the National Firearms Act, permits the transfer of marihuana to non registered persons upon the payment of a heavy transfer tax.(p.9) The Court repeated the rule that so long as a statute APPEARS upon its face to be a revenue measure, the Court cannot go behind the statute and inquire as to the motives which impelled Congress to enact it, although those motives may have been to REGULATE, rather than to raise revenue. (p.10) Mr. Anslinger: "...marihuana is the same as Indian hemp, and is sometimes found as a residual weed, and sometimes as the result of a dissemination of birdseed. It is known as cannabis, cannabis Americana, or cannabis Sativa. Marihuana is the Mexican term for cannabis Indica. We seem to have adopted the Mexican terminology, and we call it marihuana, which means GOOD-FEELING. (p.18) Mr. Anslinger: ..."At the Geneva Convention in 1895 the term "cannabis" included only the dried flowering or fruiting top of the pistillate plant as the plant source of the dangerous resin, from which the resin had not been extracted....we have urge the States to revise their definition so as to include all parts of the plant, as it now seems that the seeds and portions other than the dried flowering tops contain positively dangerous substances...as a matter of fact, the staminat leaves are about as harmless as a rattlesnake...this drug is entirely the monster Hyde."(p.19) Cannabis Indica is the medicinal preparation known to physicians.(p.22) Mr. Lewis: What is the legitimate distribution of the drug. Mr. Anslinger: There is its use in medicine. Then the hemp product is used in some parts of Kentucky, Minnesota, and Wisconsin. It is grown for hemp purposes. It makes very fine cordage, and this legislation exempts the mature stalk when it is grown for hemp purposes. Mr. McCormick. There are other commercial purposes. Mr. Anslinger. Yes. Mr. McCormack. There is the fiber out of which hats are made? Mr. McCormack: Then is not the seed used for paints and oil. Mr. McCormack: And it is also used as a constituent of commercial bird seed. (The following statements were submitted by Mr. Anslinger) Marihuana is the same as Indian hemp, hashish, cannabis, cannabis Americana, or cannabis sativa. Marihuana is the Mexican term for cannabis indica. The term "cannabis" in the Geneva Convention of 1925 and in the Uniform Narcotic Drug Act included only the dried flowering or fruiting tops of the pistillate plants as the plant source of the dangerous resin. Research during the past few months show conclusively that this definition is insufficient as we have found by experiment that the leaves of the pistillate plant as well as the leaves of the staminate plant contain the active principal up to 50 percent of the U. S. P. strength....we are urging the several States to revise their definition to include all parts of the plant as it now appears that the seeds and portions other than the dried flowering tops contain positively dangerous substances...(p.29) MARIHUANA IS THE MEXICAN TERM FOR CANNABIS INDICA. The plant or drug known as Cannabis indica, or marihuana, has as its parent the plant known as Cannabis sativa. It is popularly known in India as Cannabis Indica; in America, as Cannabis americana, Cannabis indica, or Cannabis mexicana, in accordance with the geographical origin of the particular plant.(p.37) TAXATION OF MARIHUANA WEDNESDAY, APRIL 28, 1937 Mr. Hester: All legitimate users of marihuana are exempted from the provisions of this bill which imposes taxes upon transfers of marihuana and require such transfers to be made on order forms obtained from the collector of internal revenue, except purchasers of marihuana seeds for use in the making of bird seed, or marihuana seeds as bird seed, and purchasers of the flowering tops and leaves of marihuana for use in the making of the refined drug product. Those legitimate users of marihuana who are exempted from these transfer taxes and order form requirements, are purchasers of the mature stalk of marihuana for use in the making of fiber products such as twine, purchasers of marihuana seeds for the further planting of marihuana and the manufacture of oil, and purchasers of such oil for use in the manufacture of paints and varnishes. Hemp. since the definition of marihuana in the bill excludes the mature stalk of the plant and any product or manufacture of such stalk such as twine, all hemp, fiber, or cordage manufacturers and dealers would not be subject to any provision of the bill. ...However, any person who grows marihuana, even if for the sole purpose of sale to a hemp manufacturer, would have to pay an occupational tax as a producer. The reason for this is that such production cannot be limited to the mature stalks of such plant since the stalk cannot be grown without also producing the flowering tops and leaves.(p.46) STATEMENT OF Dr. Munch. "Marihuana" is the name for Cannabis in the Mexican Pharmacopoeia. STATEMENT OF The plant cannabis sativa, so-called by Linnaeus in 1753, constitutes one species of hemp that has been known longer than any other fiber plant in the world. IT WAS CULTIVATED IN CHINA AT LEAST THREE CENTURIES BEFORE CHRIST. ....there are different botanists who have seen the different forms of the plant and have given it different names, so far as its identity is concerned....there is only one species known as hemp. The term "hemp" is better known than marihuana because the name marihuana has been used only for the drug, while hemp is used in connection with the production of fiber. I was working with the fiber and not with the drug; that was incidental. STATEMENT OF If the committee please, the hemp seed, or the seed of the cannabis sativa L. is used in all the Oriental nations and also in a part of Russia as food. It is grown in their fields and used as oatmeal. Millions of people every day are using hemp seed in the Orient as food (p.61)... The point I make is this, that this bill is too all-inclusive. This bill is a world encircling measure. This bill brings the activities, the crushing of this great industry under the supervision of a bureau, WHICH MAY MEAN ITS SUPPRESSION... In the last 3 years there have been 193,000,000 pounds of hemp seed imported into this country, or an average of 64,000,000 pounds a year... Mr. Woodruff: What is the oil used for? Mr. Lozier: It is a drying oil, and its use is comparable to that of linseed oil or a perilla oil. It has a high iodine principle or strength. It is a rapidly drying oil to use in paints. It is also used in soap and in linoleum (p.61). Mr. Lozier: ...They manufacture this oil (hemp seed) and sell it in tank cars. They have been engaged in this business for years, and never until the last 3 weeks was any suggestion made that they were handling a commodity that was carrying a deleterious principle that was contributing to the delinquency of the people of the United States(p.63). FURTHER STATEMENT OF AMENDMENTS TO H. R. 6358 Hempseed oil, hempseed cake, hempseed meal, and all products manufactured from the above may be eliminated from the preview of the bill by amending section (b), which contains the definition of marihuana, to read as follows: The term marihuana includes all parts of the plant Cannabis sativa L., whether growing or not: the seeds thereof; the resin extracted from any part of such plant; and every compound manufacture, salt, derivative, mixture, or preparation of such plant, its seeds or resin; but shall not include the mature stalks of such plant, oil, or cake made from seeds, and any compound, manufacture, salt, derivative, mixture, or preparation of such mature stalks, oil or cake.....Since paints, varnishes, and hempseed oil, under the definition as amended, will not be included within the term :marihuana:, it is no longer necessary to exempt these products from the transfer tax. (p.69)TAXATION OF MARIHUANA FRIDAY, APRIL 30, 1937 STATEMENT OF There has been an amendment proposed to section 1 (b) by excluding from the definition of marihuana sterilized seed which is incapable of germination, so that section 1 (b), as so amended, would read as follows: The term "marihuana" includes all parts of the plant Cannabis sativa L., whether growing or not; the seeds thereof: the resin extracted from any part of such plant; and every compound, manufacture, salt, derivative, mixture, or preparation of such plant, its seeds or resin; but shall not include the mature stalks of such plant, oil, or cake, and the sterilized seed of such plant which is incapable of germination. Mr. Scarlett: Until Monday of this week we did not know there was any connection between the two i.e. hempseed and marihuana. When this bill came out and we saw that it was called a bill to impose an occupational excise tax upon dealers in marihuana we paid no attention to it. Nobody in the seed trade refers to hempseed as marihuana. Hempseed is a harmless ingredient used for many years in the seed trade. The trade at large do not know that this bill that is under consideration contains any provision affecting them, because the title of the bill would give them no knowledge that it was hempseed that was under discussion. (p.76) STATEMENT OF Mr. Hester: It is the ordinary field hemp growing wild, or at least without the extensive cultivation necessary to provide good fiber. The committee may have been confused because we have used the term marihuana in this bill. The reason for that is this. This is the hemp drug, commonly known in Mexico and in the United States as marihuana. It is just a colloquial term in Mexico, as I understand it, and means the flowered tops and leaves of the hemp plant, the subject of the taxes contained in this bill because it was not intended to tax the whole plant, but merely the parts of the plant which contain the drug. The parts of the plant which contain the drug are commonly known as marihuana, so the taxes were imposed upon "marihuana." In addition, I might say that some people say that the marihuana seed should be called fruit, because, botanically speaking, it is a fruit, not a seed. (p.78) Mr. Reed: YOU WILL HAVE A REVOLUTION ON YOUR HANDS if, as you say, this plant grows generally throughout the country and you try to charge the farmers a tax of $25, as you said. (p.79) Mr. Dingell. Mr. Hester, do you not believe that the average farmer would be willing to use a mowing machine or a scythe if he thought that in that way or any way at all after a year or 2 years he could exterminate and KILL THE WEED WHICH KILLS PEOPLE? (p.83) Mr. Crowther. According to a brief that has been submitted, as a rule the addict passes into a dreamy state, in which judgment is lost, the imagination runs rampant; he is subject to bizarre ideas, lacking in continuity, and losing all sense of the measurement of time and space. (p.84) Mr. Hester. ...we feel that we should submit to the Secretary of the Treasury, the question as to whether the Treasury Department would object to the proposed amendment which will except from the definition of the term marihuana sterilized seeds, which have been made incapable of germination. (p.85) TAXATION OF MARIHUANA Tuesday, May 4, 1937 STATEMENT OF THE TERM "MARIHUANA" IS A MONGREL WORD THAT HAS CREPT INTO THIS COUNTRY OVER THE MEXICAN BORDER AND HAS NO GENERAL MEANING, EXCEPT AS IT RELATES TO THE USE OF CANNABIS PREPARATIONS FOR SMOKING. It is not recognized in medicine, and I might say that is is hardly recognized even in the Treasury Department. I have here a copy of a letter written by the Acting Secretary of the Treasury, April 15, 1937, in which he says: Marihuana is one of the products of the plant Cannabis sativa l., a plant which is sometimes referred to as Cannabis americana or Cannabis indica. In other words, MARIHUANA IS NOT THE CORRECT TERM. It was the use of the term "marihuana" rather than the use of the term "Cannabis" or the use of the term "Indian hemp" that was responsible, as you realized, probably, a day or two ago, for the failure of the dealers in Indian hempseed to connect up this bill with their business until rather late in the day. So, if you will permit me, I shall use the word "Cannabis", and I should certainly suggest that if any legislation is enacted, the term used be "Cannabis" and not the mongrel word "marihuana." I say the medicinal use of Cannabis has nothing to do with Cannabis or marihuana addiction. In all that you have heard here thus far, no mention has been made of any excessive use of the drug by any doctor or its excessive distribution by any pharmacist. And yet the burden of this bill is placed heavily on the doctors and pharmacists of the country; and I may say very heavily, most heavily, possibly of all, on the farmers of the country.(p.90) The medicinal use of Cannabis, as you have been told, has decreased enormously....To say, however, as has been proposed here, that the use of the drug should be prevented by a prohibitive tax, loses sight of the fact that future investigation may show that there are substantial medical uses for cannabis. ...Indian hemp has remarkable properties in revealing the subconscious; hence it can be used for psychological, psychoanalytical, and psychotherapeutic research, though only to a very limited extent... That use, by the way, was recognized by John Stuart Mill in his work on psychology, where he referred to the ability of Cannabis or Indian hemp to revive old memories, and psychoanalysis depends on revivification of hidden memories..(p.92)

By It would be a sharp blow to the legislative process and to the pride and reputation of legislative bodies if the present laws remain unexamined long enough to force a court to look at the facts and conclude that the marijuana laws were passed without any investigation into what is known by experts -sociologists, psychologists, psychiatrists, pharmacologists, and so forth. This might well happen when the concept of Due Process of Law is interpreted so as to require a legislature to look at the facts before it passes severe penal laws. Yet the legislatures, including the Congress of the United States, have thus far chosen to continue accepting the old well-worn myths propagated by men with no scientific objectivity or training. To those who were given a, perhaps, too rosy view of the legislative process in high school civics classes, it is probably surprising to see how, despite an increasingly loud debate on the medical effects of marijuana and on the wisdom, indeed the legality, of the Marijuana Tax Act, the 'spirit of '37' still prevails when 'the marketplace of free ideas' tries to gain entry into the legislative chambers of the nation." (pp.160-161.)

I had a similar argument in

|